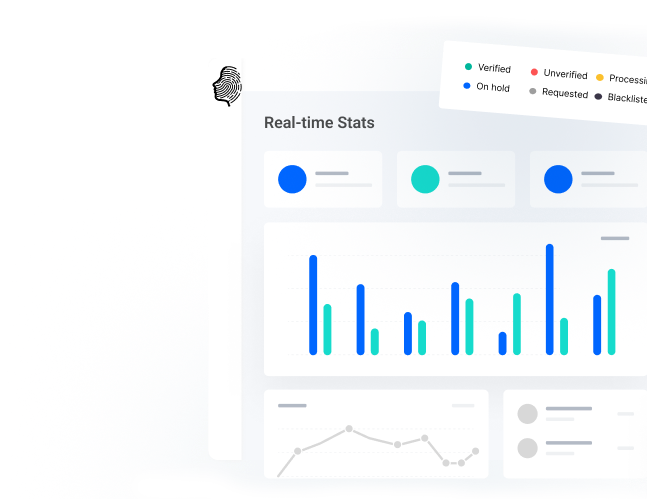

Ensure your financial institution detects and prevents suspicious activities with our advanced KYT solution

In an era where financial crimes are becoming increasingly sophisticated, staying ahead of threats is crucial. Introducing KYT by kyc.me, the ultimate solution for transaction monitoring and AML compliance.